UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

| | | | | | | | |

| Filed by the Registrant ☒ | | |

| Filed by a Party other than the Registrant ☐ | | |

| | |

| Check the appropriate box: | | |

☐☒ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

☒☐ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material under §240.14a-12 | |

| | |

BEAZER HOMES USA, INC. (Name of registrant as specified in its charter) | | |

| | |

| (Name of person(s) filing proxy statement, if other than the registrant) | | |

| | |

| Payment of Filing Fee (Check the appropriate box): | | |

| ☒ | No fee required. | |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| | |

| ☐ | Fee paid previously with preliminary materials. | |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

| | |

Explanatory Note: This filing is identical to a previous filing on December 20, 2019, which was inadvertently designated as a DEFA14A instead of a DEF 14A.

| | |

FROM OUR

CHAIRMAN

Dear Fellow Stockholders:

We had a very successful fiscal year, driven by strong operational execution and continued strength in the housing market. We generated significant gains in operating margin and adjusted EBITDA, leading to full year net income that was more than double last year’s. We also significantly grew our total active lot position and reduced our leverage. These outcomes are the result of our long-standing Balanced Growth Strategy — which is our multi-year plan to grow profitability faster than revenue, from a less leveraged and more efficient balance sheet.

As we improve our financial and operational performance, we are also focused on expanding our ESG activities to create durable value for all of our stakeholders. To that end, we were pleased to be named an ENERGY STAR® Partner of the Year — Sustained Excellence for the sixth consecutive year. Every home we build is ENERGY STAR-certified, and we continue to make improvements in our designs, materials and construction practices in support of our industry-first pledge to have 100% of the homes we build certified as Net Zero Energy Ready by the end of 2025.

We also made significant progress on the rollout of Charity Title, our title insurance agency business committed to contributing 100% of its profits to charity. We expect this expansion will allow us to donate more than $1 million in fiscal 2022, allocated between our national philanthropic partner, Fisher House Foundation, and other charitable organizations in the communities we serve.

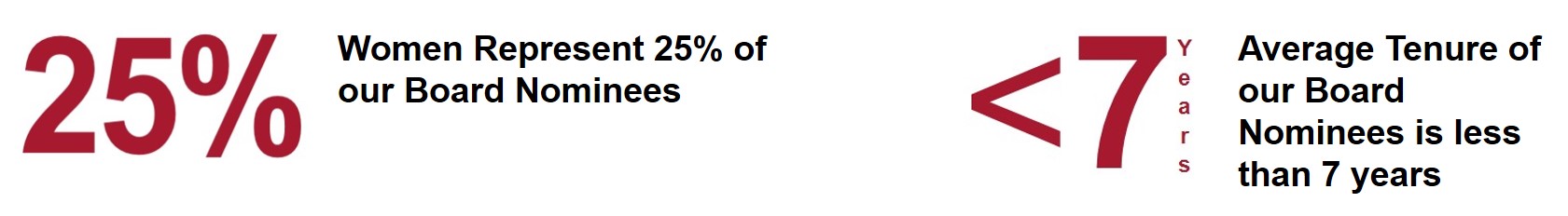

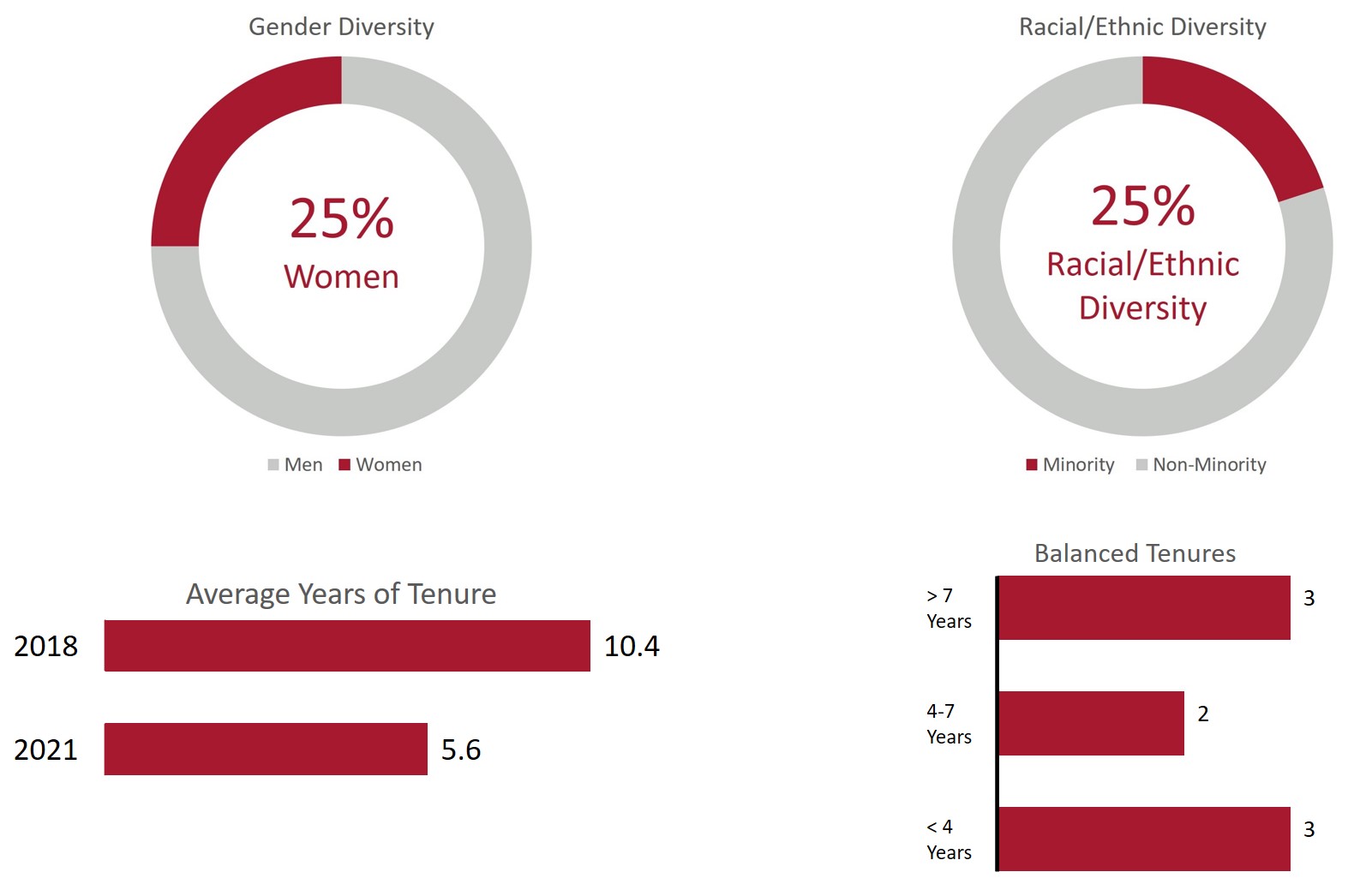

On the Governance side, we recently completed a three-year Board refreshment process that resulted in four long-serving directors retiring and three new directors joining our Board. The average tenure of our directors is now 5.6 years, compared to 10.4 years in 2018. The diversity of our Board was also enhanced as a result of this process.

As noted on page 5 of our Proxy Statement, we recently posted on our website our first-ever ESG Summary, which provides information on our ESG-related initiatives, as well as metrics that are responsive to sustainability accounting standards promulgated by the Sustainability Accounting Standards Board (SASB) for companies within the homebuilding industry. This summary represents another step forward in our commitment to meaningful ESG accountability and provides a foundation upon which we expect to build increased transparency by directly reporting on relevant sustainability issues, risks and opportunities that impact our business.

During fiscal 2021, we held more than 90 meetings with investors and discussed many important topics, including executive compensation and ESG matters. We listened closely and our Board and committees implemented several meaningful initiatives based on these engagements.

With respect to executive compensation specifically, we believe pay and performance were strongly linked in fiscal 2021, supporting our key financial, operational and strategic objectives, and aligning our compensation program with best practice principles. Based on the feedback we received from investors during the year, we believe our compensation philosophy is in alignment with their views, while also continuing to reinforce our strategic priorities. We, therefore, respectfully request your support this year on our annual say-on-pay proposal.

Last – but certainly not least – you will see under Proposals 4 and 5 that we are once again asking for stockholder approval of certain protective measures that will help us preserve our ability to fully maximize our net operating losses, or NOLs, that we use (and want to continue to use) to offset the taxable income we are now generating and expect to continue to generate in the future. These protections, which have a three-year term, are currently set to expire in November 2022, and have been overwhelmingly supported by our stockholders since they were first adopted by our Board of Directors. Because our NOLs have substantial value to us, we hope you will support the renewal of these protections for an additional three-year term until November 2025.

FROM OUR

CHAIRMAN OF THE BOARD

Dear Fellow Stockholders:

The 2020 annual meeting of stockholders ofThank you for your continued support as we execute our strategy. We believe that we are positioning Beazer Homes USA, Inc. will be held at 8:30 a.m., Eastern Time,for more growth and more profitability, leading to higher returns on Wednesday, February 5, 2020, at The Westin Atlanta Perimeter North, 7 Concourse Pkwy, NE, Atlanta, Georgia 30328, for the following purposes:stockholders’ equity. As always, we appreciate your confidence in us.

l

Election of the eight directors named in the accompanying proxy statement to serve until our annual meeting in 2021;

lRatification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for fiscal 2020;

lApproval of the compensation of our named executive officers;

lApproval of the amended and restated 2014 Long-Term Incentive Plan; and

lTransaction of any other business that may properly come before the meeting or any adjournments or postponements thereof.

Holders of record of our common stock as of the close of business on December 11, 2019 are entitled to notice of, and to vote at, the annual meeting. For instructions on voting, please refer to the Notice of Internet Availability of Proxy Materials you received by mail or the section entitled “How to Vote” beginning on page 1 of this proxy statement. If you received a paper copy of this proxy statement, please refer to the enclosed proxy card.

Your vote is important. Whether or not you plan to attend the annual meeting, we encourage you to vote as soon as possible.

By Order of the Board of Directors,

ALLAN P. MERRILL

Chairman, President and Chief Executive Officer

Beazer Homes USA, Inc.

December 20, 2019

__, 2021

| | |

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be held on February 5, 2020:2, 2022: This proxy statement, along with the Company’s Annual Report on Form 10-K for the fiscal year ended September 30, 2019,2021, are available free of charge on the Company’s website at http://www.beazer.com |

PROXY

STATEMENT SUMMARY

This executive summary provides an overview of the information contained within this proxy statement. We encourage you to read the entire proxy statement prior to voting.

ANNUAL MEETING OF STOCKHOLDERS ROADMAP

ANNUAL MEETING

| | | | | | | | | | | |

| When: | Wednesday, February 5, 20202, 2022 8:30 a.m. (Eastern time) | Where: | The Westin Atlanta Perimeter North1000 Abernathy Road, NE,

7 Concourse Pkwy, NESuite 260

Atlanta, Georgia 30328 |

Stockholders of record as of the close of business on December 11, 20198, 2021 are entitled to notice of, and to vote at, the annual meeting.

This proxy statement, along with the Company’s Annual Report on Form 10-K for the fiscal year ended September 30, 2019,2021, are available on the Company’s website at beazer.com.www.beazer.com.

On December 20, 2019,__, 2021, we began mailing this proxy statement to stockholders who requested paper copies.

For instructions on voting, please refer to the Notice of Internet Availability of Proxy Materials you received by mail or the section entitled “How to Vote” beginning on page 2 of this proxy statement.If you received a paper copy of this proxy statement, please refer to the enclosed proxy card.

Your vote is important. Whether or not you plan to attend the annual meeting, we encourage you to vote as soon as possible.

VOTING MATTERS

| | | | | | | | |

| PROPOSAL | BOARD’S VOTING

RECOMMENDATION | PAGE

REFERENCE |

| Election of directors | For Each

Nominee | 1215 |

| Ratification of appointment of independent auditors | For | 1722 |

| Approval of executive compensation | For | 1924 |

| Amendment of Amended and Restated Certificate of Incorporation to preserve tax benefits | For | 55 |

Approval of the Company's amended and restated 2014 Long-Term Incentive Plana new Section 382 Rights Agreement to preserve tax benefits | For | 4457 |

20192021

BUSINESS HIGHLIGHTS

As we began fiscal 2019, the new home sales market was very challenging, driven by rapidly rising mortgage rates that contributed to affordability concerns and a softening in demand. In that environment, we increased incentives to spur home sales and allocated capital to debt reduction and share repurchases. This response — together with improvements in the overall sales environment and a successful refinancing to reduce borrowing costs — improved results in ways that will be even more meaningful in fiscal 2020.

For fiscal 2019, we:

•Improved new home orders, backlog and community count, which provides a solid foundation for growth as we move into fiscal 2020;

•Improved operations by streamlining our product offerings, which has led to higher customer satisfaction scores, reduced construction cycle times and lower build costs; and

•Improved allocation of capital, which enabled both investment in our business and the return of nearly $90 million to investors.

In short, despite a tough sales environment at the start of fiscal 2019, we ended the year in a better position than we began. Here are several highlights of our financial and operational achievements in fiscal 2019:

2021: | | | | | | | | |

| FINANCIAL | |

| $2.1 BILLION | Revenue |

| | Achieved $2.1 billiona slight increase in homebuilding revenue despite a 3.7% year-over-year decrease in home closings |

| $180.2122.2 MILLION | Net Income |

| | Generated net income from continuing operations of $122.2 million compared to $53.3 million in fiscal 2020 |

| $262.7 MILLION | Adjusted EBITDA |

| | Achieved $180.2$262.7 million in Adjusted EBITDA, an increase of $58.3 million, or 28.5%, year-over-year |

| $51.380.7 MILLION | Debt RepurchasesReduction |

| | Repurchased $51.3 million of debt. We expect to reduceReduced our outstanding debt in 2020 by more than we did in 2019, with the goal of reducing debt below $1 billion over time |

| $500.0 MILLION | Refinancing |

| | We issued $350 million of 7.25% unsecured Senior Notes due 2029 and entered into an unsecured term loan with a principal amount of $150$80.7 million. The proceeds from these transactions were used to refinance $500 million of 8.75% unsecured Senior Notes due 2022, which generated a $11 million per year reduction in cash interest cost |

| $34.6 MILLION | Share Repurchases |

| | We repurchased $34.6 million of our outstanding common stock at an average price of $10.54 per share |

| | |

| OPERATIONAL | |

| 2.8 3.7 HOME

SALES/MONTH | Sales Pace |

| | Achieved average monthly home sales pace per community of 2.8,3.7, a year-over-year increase of 13.8% |

| $595.5 MILLION | Land Acquisition and Land Development Spending |

| | Spent $595.5 million on land acquisition and land development, a 35.1% year-over-year increase |

| $1.3 BILLION | Dollar Value of Backlog |

| | Ended the year with dollar value of homes in linebacklog of $1.3 billion, a year-over-year increase of 29.0% |

| $402,400 | Average Selling Price |

| | Average selling price (ASP) for our homes was $402,400, marking our tenth consecutive year of ASP growth and reflecting an increase of more than 4% year-over-year |

| 127 COMMUNITIES | Average Community Count |

| | Average active community count was 127, a 22.3% year-over-year decrease |

| 21,987 LOTS | Number of Controlled Lots |

| | Ended the year with 21,987 lots controlled either through ownership or options to purchase, a year-over-year increase of 23.3% |

For fiscal 2022, we expect to: •grow EBITDA by more than 10%, leading to earnings per share of more than $5.00 •grow our targetslot position by double digits, with lots controlled by options remaining around 50% •deliver a return on total equity of about 20%, or nearly 25% excluding our deferred tax assets, and •reduce our total debt below $1 billion |

| | |

| Please see Annex I for a reconciliation of non-GAAP measures to GAAP measures. Statements regarding expectations for fiscal 2022 are forward-looking statements, which involve known and unknown risks, uncertainties and other factors described in our Annual Report on Form 10-K for the fiscal year ended September 30, 2021. |

| | | | | | | | |

| | |

| $377.7 THOUSAND | Average Selling Price |

| | Our average selling price (ASP) for the year was $377,700, marking our eighth consecutive year of ASP growth and reflecting an increase of 4.9% year-over-year, primarily related to changes in geographic mix |

| 166 COMMUNITIES | Community Count |

| | Ended the year with an active community count of 166 |

| | |

During fiscal 2020, we expect to continue to pursue our balanced growth strategy, which is designed to improve profitability and returns from a more efficient and less leveraged balance sheet. In particular, we are targeting EBITDA growth in excess of 10% and more than $50 million in debt reduction, with a net debt to EBITDA ratio below 5 times. | | |

| | |

Please see Annex I for a reconciliation of non-GAAP measures to GAAP measures. |

CORPORATE

GOVERNANCE HIGHLIGHTS

| | | | | | | | | | | | | | |

| ü | Annual election of all directors | | ü | Clawbacks of incentive awards in the event of a restatement |

ü | Majority vote standard for the election of directors | | ü | Double triggers for both cash severance and accelerated vesting of equity upon a change inof control |

| ü | OfficerSignificant director refreshment over last three years, reducing average tenure from 10.4 years to 5.6 years | | ü | Robust and thorough Board, committee and director evaluation practices to enhance effectiveness |

| ü | Majority vote standard for the election of directors, with a director resignation policy | | ü | Long-standing stockholder engagement practices |

| ü | Meaningful officer and director stock ownership and holding requirements | | ü | Robust Board and Committee evaluation practicesNo tax gross-ups in connection with severance or change of control |

| ü | Policies against hedging, pledging and stock option repricing | | ü | Long-standing stockholderBoard engagement practicesand oversight on all ESG matters |

| ü | Clawbacks of incentive awards in the event of a restatement | | |

| |

STOCKHOLDER

ENGAGEMENT

We are committed to a robust stockholder engagement program. Our Board values our stockholders’ perspectives and feedbackperspectives. Feedback from stockholders on our business, corporate governance and executive compensation areprogram and ESG matters represent important considerations for Board discussions throughout the year. Over the course of the year, our teamwe held more than 7090 meetings with stockholders and investors.

Our Board maintains a process for stockholders and interested parties to communicate with the Board. Stockholders and interested parties may write or call our Board as provided under “Corporate Governance”“ESG — Corporate Governance Overview” on page 11.15.

BOARD

NOMINEES (PG. 15)

Below are the directors nominated for election by stockholders at the annual meeting. The Board recommends a vote “FOR” each of the directors. | | | | | | | | | | | | | | |

| AGE | SERVING SINCE | PRINCIPAL OCCUPATION | INDEPENDENT |

| Elizabeth S. Acton | 70 | 2012 | Former Executive Vice President Finance and Chief Financial Officer

Comerica Incorporated | Yes |

| Lloyd E. Johnson | 67 | 2021 | Former Global Managing Director, Finance and Internal Audit

Accenture Corporation | Yes |

| Allan P. Merrill* | 55 | 2011 | President and Chief Executive Officer

Beazer Homes USA, Inc. | No |

| Peter M. Orser | 65 | 2016 | Former President and Chief Executive Officer

Weyerhaeuser Real Estate Company | Yes |

| Norma A. Provencio** | 64 | 2009 | President and Owner

Provencio Advisory Services Inc. | Yes |

| Danny R. Shepherd | 70 | 2016 | Former Vice Chairman, Senior Vice President, Executive Vice President and

Chief Operating Officer

Vulcan Materials Company | Yes |

| David J. Spitz | 49 | 2019 | Chief Executive Officer

ChannelAdvisor Corp. | Yes |

| C. Christian Winkle | 58 | 2019 | Former Chief Executive Officer

Sunrise Senior Living | Yes |

*Chairman

**Lead Director

BOARD

NOMINEES (PG. 12)

Below are the directors nominated for election by stockholders at the annual meeting. The Board recommends a vote “FOR” each of the directors.

| | | | | | | | | | | | | | |

| AGE | SERVING SINCE | COMMITTEES SERVED | INDEPENDENT |

| Elizabeth S. Acton | 68 | 2012 | Audit, Finance (Chair) | Yes |

| Laurent Alpert | 73 | 2002 | Nom/Corp Gov, Finance | Yes |

| Allan P. Merrill | 53 | 2011 | Not Applicable* | No |

| Peter M. Orser | 63 | 2016 | Compensation (Chair), Finance | Yes |

| Norma A. Provencio | 62 | 2009 | Compensation, Nom/Corp Gov (Chair)** | Yes |

| Danny R. Shepherd | 68 | 2016 | Audit (Chair), Compensation | Yes |

| David J. Spitz | 47 | 2019 | Compensation | Yes |

| C. Christian Winkle | 56 | 2019 | Finance | Yes |

*Chairman

**Lead Director

BOARD AND

COMMITTEE COMPOSITION (PG. 8)11)

The standing committees of the Board are the Audit Committee, Compensation Committee, Nominating/Corporate Governance Committee and Finance Committee. Below are our current directors and their committee memberships and their 2019 attendance rates formemberships. Each of our directors attended at least 75% of the regularly scheduled Board and committee meetings during the period he or she was on the Board.

As partBoard, with seven of the Board's comprehensive, long-term Board succession plan, threeeight attending 100% of our current directors are retiring and will not stand for reelection at the annual meeting. Retiring directors are noted below.such meetings.

| | | | | | | | | | | | | | | | | |

| AUDIT | COMPENSATION | NOMINATING/CORPORATE GOVERNANCE | FINANCE | ATTENDANCE

RATE |

| Elizabeth S. Acton | l | | | l | 100% | |

Laurent Alpert | | Lloyd E. Johnson | l | l | 100% | |

Brian C. Beazer* | | l | | l | 100% | |

Peter G. Leemputte* | l | | l |

| 100% |

|

| Allan P. Merrill | | | | | 100% | |

| Peter M. Orser | | l | | l | 100% | |

Norma A. ProvencioProvencio* | | l | l | | 100% | |

| Danny R. Shepherd | l | | l | | | 100% | |

| David J. Spitz | | l |

l | | 100% | |

| C. Christian Winkle | l | | | l | 100% | |

Stephen P. Zelnak, Jr.* | l | | l | | 94% | |

lChair

*Retiring director. Lead Director

KEY

QUALIFICATIONS

The following are several of the key qualifications, skills and experience of our Board nominees that we believe are uniquely important to our business.

| | | | | | | | | | | | | | |

| ü | Homebuilding/Construction Industry Experience Merrill, Orser, Shepherd | | ü | CEO/COO Experience Merrill, Orser, Shepherd, Spitz, Winkle |

| | | | |

| ü | CFO/Accounting/Finance Experience Acton, Johnson, Merrill, Provencio, SpitzShepherd | | ü | Public Company Board Experience Acton, Johnson, Merrill, Provencio, Shepherd, Spitz, Winkle |

| | | | |

| ü | Marketing/Sales Expertise Corporate Governance/Ethics

Merrill, Orser,Provencio, Shepherd, Spitz | | ü | Corporate GovernanceRisk Management

Acton, Johnson, Merrill, Provencio, Shepherd, Winkle |

| | | | |

| ü | Marketing/Sales ExpertiseAlpert, Merrill, Orser, Spitz | | ü | ESG Expertise Merrill, Orser, Provencio, Shepherd, Spitz |

The lack of a mark for a director does not mean that he or she does not possess that particular qualification, skill or experience. The marks above simply indicate that the characteristic is one for which the director is especially well known among our Board.

We believe our Board reflects the broad expertise and perspective needed to govern our business and constructively engage with senior management.

HOW

WE PAY

Our executive compensation program is composed of the following elements:

| | | | | | | | | | | | | | |

| ü | Base salary | | ü | Long-term equity incentive compensation, (performance shareswith the majority of target award opportunities tied to multi-year performance goals and payable in stock and cash, as well as restricted stock) |

| | | | stock |

| ü | Short-term cash incentive compensation, based on performance | | ü | Benefits available to all employees |

FISCAL 2019

2021

EXECUTIVE COMPENSATION ACTIONS

| | | | | |

ü | No changes were made to Mr. Merrill’s base salary. Mr. Salomon’s base salary was increased from $550,000 to $600,000, and Mr. Belknap's base salary was increased from $450,000 to $500,000, in each case primarily to align salary more closely with industry peers. |

| |

ü | No changes were made to Mr. Merrill’s long-term incentive award opportunity. Mr. Salomon’s long-term incentive target award opportunity was increased from 175% to 200% of base salary, and Mr. Belknap's long-term incentive target award opportunity was increased from 125% to 150%, in each case primarily to align target incentives more closely with expanded roles and responsibilities. |

| |

ü | No changes were made to the short-term incentive award opportunities, expressed as percentages of base salary, of any named executive officer (NEO). We based 65% of the fiscal 2019 short-term incentive opportunity for NEOs on achievement of Bonus Plan EBITDA, 10% on Return on Assets (ROA) and 25% on key operational metrics. |

| |

ü | We determined to use operational objectives identical to those used in determining the fiscal 2018 short-term incentive opportunity, with the addition of an objective related to further improving overhead efficiency. |

| |

ü | We determined that NEOs would be eligible to receive an award for the operational components of the 2019 short-term bonus opportunity only if threshold Bonus Plan EBITDA was achieved. |

| |

ü | We retained the discretion to deduct from awards earned for failure to achieve certain construction quality standards based on the assessment of an independent third-party expert. |

| |

ü | We continued our practice of awarding performance shares equal to two-thirds of an NEO’s overall long-term incentive target award opportunity, and time-based restricted stock equal to one-third of the target award opportunity. |

| |

ü | We based 2019-2021 performance share metrics on cumulative pre-tax income, return on assets and expansion of our Gatherings® product line. |

| |

ü | We continued to include an adjustment to performance shares based on 3-year relative total shareholder return (TSR) performance vs. companies in the S&P Homebuilders Select Industry Index. |

HIGHLIGHTS

Base Salaries (PG. 32)

As we reported in our 2020 Proxy Statement, due to a significant decline in net new orders and the Company's focus on protecting liquidity at the onset of the COVID-19 pandemic, our named executive officers (NEOs, as defined on page 25) voluntarily reduced their respective salaries by 20%, effective April 1, 2020. Those reductions remained in place for all of fiscal 2020.

PERFORMANCE-BASED

COMPENSATION OUTCOMES

Compensation outcomes fromWhile market conditions had improved dramatically by the beginning of fiscal 2021, our NEOs voluntarily extended a portion of base salary reductions, equal to 10% of their respective pre-pandemic annual salaries, into fiscal 2021, subject to the possibility of salaries being restored for the second half of fiscal 2021 if the Company's performance incentivesat that time was on pace to exceed 95% of its annual plan. As a result, Mr. Merrill began fiscal 2021 with a base salary of $877,500 and Mr. Goldberg and Mr. Belknap began fiscal 2021 with base salaries of $382,500 and $486,000, respectively. Because the Company's results for the first half of fiscal 2021 exceeded 95% of the Company's annual plan, the NEOs' salaries were well-aligned withrestored to pre-pandemic levels for the performance our management team achieved duringsecond half of the year, resulting in actual base salaries earned in fiscal 2019:

| | | | | |

ü | Annual cash incentives were earned between threshold and target award opportunity levels based on actual vs. planned outcomes for the operational and financial performance factors, with payouts for the NEOs lower by an average of 41.0% compared with the prior year, despite a reduction in Adjusted EBITDA of 12.0%. |

| |

ü | The three-year award cycle of the 2017 performance share program ended on September 30, 2019, with results yielding a payout relative to target of 157.5% (after applying a TSR modifier). Metrics included pre-tax income, ROA and ratio of net debt/Adjusted EBITDA, which were collectively subject to a TSR modifier. |

2021 of $926,384 for Mr. Merrill, $403,808 for Mr. Goldberg and $513,074 for Mr. Belknap.

Short-Term Incentive Opportunities (PG. 33)

In addition to the reduction in base salaries discussed above, our NEOs voluntarily reduced their respective target short-term incentive award opportunities by 10% for all of fiscal 2021. After taking into account these 10% reductions in short-term incentive opportunities, the target short-term incentive award opportunities for our NEOs (expressed as percentages of weighted salary) were 157.5% for Mr. Merrill, 90.0% for Mr. Goldberg and 112.5% for Mr. Belknap.

Our Compensation Committee determined that our NEOs would be eligible to receive an award for the operational components of the 2021 short-term bonus opportunity only if threshold Bonus Plan EBITDA was achieved. Furthermore, the Committee retained the discretion to deduct from awards earned for any reason, including the failure to achieve certain construction quality standards based on the assessment of an independent third-party expert.

Long-Term Incentive Opportunities (PG. 35)

In addition to the reductions discussed above, our NEOs voluntarily reduced their respective target long-term incentive award opportunities by 10% for all of fiscal 2021. After taking into account these 10% reductions in long-term incentive opportunities, the target long-term incentive award opportunities for the NEOs (expressed as percentages of already reduced salary) were 270.0% for Mr. Merrill, 135.0% for Mr. Goldberg and 157.5% for Mr. Belknap.

For the 2021-2023 performance period, our Compensation Committee continued its practice of tying two-thirds of target long-term incentive award opportunities to multi-year performance goals, with one-half of the performance-based component payable in cash and one-half payable in performance shares, subject to the same performance criteria.

In addition, our Compensation Committee continued to include a relative total shareholder return (TSR) modifier to NEO performance share and performance cash awards, which could result in an adjustment to any earned awards (by up to +/- 20%) based on our three-year relative TSR performance vs. companies in the S&P Homebuilders Select Industry Index.

COMPENSATION OUTCOMES (PGS. 34 and 37)

Compensation outcomes from performance incentives were well-aligned with Company and management team performance during fiscal 2021. Based on actual vs. planned outcomes for the financial and operational performance factors, our NEOs earned 192.5% of reduced target annual incentive award opportunities.

The three-year award cycle relating to our 2019 performance share program ended on September 30, 2021, with results yielding a payout equal to 148.75% of the target award opportunity after applying a negative 15.0% TSR modifier. Metrics included cumulative pre-tax income, return on assets and expansion of our Gatherings® product line, which were then collectively subject to the TSR modifier.

RATIFICATION OF

INDEPENDENT AUDITORS (PG. 17)22)

Although stockholder ratification is not required, the appointment of Deloitte & Touche LLP as the Company’s independent auditors for fiscal 20202022 is being submitted for ratification at the annual meeting because the Board believes doing so is a good corporate governance practice. The Board recommends a vote “FOR” the ratification of Deloitte & Touche LLP as the Company’s independent auditors.

AMENDEDCHARTER AMENDMENT AND RESTATED

2014 LONG-TERM INCENTIVE PLANNEW RIGHTS AGREEMENT (PG. 44)53)

We have significant deferred tax assets comprised primarily of net operating losses, or NOLs, that we use (and want to continue to use) to offset the taxable income we are now generating and expect to continue to generate in the future. These benefits, which have substantial value to us, can be significantly impaired, however, if we experience an “ownership change” under Section 382 of the Internal Revenue Code (which is discussed in detail under “Proposals 4 and 5 — Background” on page 53). To help protect against an “ownership change” and preserve our ability to fully maximize our NOLs, our stockholders have previously approved certain protective measures, including the charter amendment and the Section 382 Rights Agreement described in Proposal 4 and Proposal 5, respectively.

These protective provisions are set to expire in November 2022. Accordingly, we are now seeking shareholderstockholder approval to amend and restate the 2014 Long-Term Incentive Plan (as amended and restated, the Amended 2014 Plan). The Amended 2014 Plan would amend and restate the 2014 Plan to, among other things, increase the number of shares available under the 2014 Plan from 3,850,000 to 5,550,000, limit the maximum value of equity awards that may be granted to any non-employee director during any fiscal year to $350,000, add a requirement that, subject to limited exceptions, all awards are subject to a minimum one-year vesting period, and to extend the termexpiration dates of each of these protective provisions by an additional three years. We have provided a brief “Frequently Asked Questions” section beginning on page 53, followed by the 2014 Plan to 10 years from the date of the annual meeting.related proposals. The Board recommends a vote “FOR” the“FOR” approval of both the Amended 2014 Plan.

protective charter amendment and the new Rights Agreement.

TABLE OF

CONTENTS

| | | | | |

| PROXY STATEMENT SUMMARY | i |

| |

| |

| |

| |

| 2 |

| |

| Revoking a Proxy | | 3 |

| Quorum | |

| Votes Needed | |

| Who Counts the Votes | | 4 |

| |

| |

| |

| |

| |

| Director Independence | |

| Board Leadership Structure and Governance Practices | |

| |

| |

| |

| |

| 10 |

| |

| |

| |

| 11 |

| |

| Audit Committee | |

| Nominating/Corporate Governance Committee | |

| Compensation Committee | |

| Finance Committee | |

| Committee Charters and Other Information | |

| |

| Director Qualifications | |

| Procedures Regarding Director Candidates Recommended by Stockholders | |

| Reporting of Concerns to Independent Directors | |

| PROPOSAL 1 — ELECTION OF DIRECTORS | |

| NON-EMPLOYEE DIRECTOR COMPENSATION | |

| PROPOSAL 2 — RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | |

| |

| |

| COMPENSATION DISCUSSION AND ANALYSIS | |

| CD&A OVERVIEW | |

| Who We Are | |

20192021 Business Highlights | 21 |

Fiscal 20192021 Compensation Highlights | 23 |

| | | | | |

| OUR OVERALL COMPENSATION PHILOSOPHY AND OBJECTIVES | 24 |

| 24 |

| Pay for Performance | 24 |

| Pay Best Practices | |

| Role of the Compensation Committee, Management and Compensation Consultants | |

| Peer Groups and Data | |

| ELEMENTS OF FISCAL 2019 COMPENSATION PROGRAM | |

| Consideration of Say on Pay Votes | 27 |

| Base Salary | |

| Short-Term Incentive Compensation | |

| Long-Term Incentive Compensation | |

| Benefits | |

| Stock Ownership and Holding Requirements | 34 |

| Compensation Clawback Policy | 34 |

| Risk Consideration In Our Compensation Programs | 34 |

Tax Legislation Related To Compensation | 35 |

| | 36 |

| EXECUTIVE COMPENSATION | | 37 |

| Summary Compensation Table | 3742 |

| All Other Compensation | 3843 |

| Grants of Plan-Based Awards Table | 3843 |

| Outstanding Equity Awards at Fiscal Year End Table | 3945 |

Option ExerciseExercises and Stock Vested Table | 4046 |

| Non-Qualified Deferred Compensation Table | 4046 |

| Potential Payments Upon Termination or Change of Control | 4147 |

| Pay Ratio | 4349 |

| SECURITY OWNERSHIP | |

| 44 |

| 54 |

| TRANSACTIONS WITH RELATED PERSONS | 57 |

| |

57OTHER INFORMATION | |

| 58A |

| 59 |

| |

| |

PROXY

STATEMENT

GENERAL

This proxy statement contains information about the 20202022 annual meeting of stockholders of Beazer Homes USA, Inc. In this proxy statement, both “Beazer” and the “Company” refer to Beazer Homes USA, Inc. This proxy statement and the enclosed proxy card are being made available to you by the Company’s Board of Directors starting on or about December 20, 2019.__, 2021.

PURPOSE OF THE ANNUAL MEETING

At the Company’s annual meeting, stockholders will vote on the following matters:

| | | | | |

l | Proposal 1: election of directors; |

| |

l | Proposal 2: ratification of appointment of Deloitte & Touche LLP as the Company’s independent auditors; |

| |

l | Proposal 3: approval of the compensation of the Company’s named executive officers; |

| |

l | Proposal 4: approvalamendment of the Company's amendedAmended and restated 2014 Long-Term Incentive Plan; andRestated Certificate of Incorporation; |

| |

l | Proposal 5: approval of a new Section 382 Rights Agreement; and |

| Transaction of any other business that properly comes before the meeting or any adjournments or postponements thereof. As of the date of this proxy statement, the Company is not aware of any other business to come before the meeting. |

WHO CAN VOTE

Only stockholders of record holding shares of Beazer common stock at the close of business on the record date, December 11, 2019,8, 2021, are entitled to receive notice of the annual meeting and to vote the shares of Beazer common stock they held on that date. The Company’s stock transfer books will not be closed. A complete list of stockholders entitled to vote at the annual meeting will be available for examination by any Beazer stockholder at 1000 Abernathy Road, Suite 260, Atlanta, Georgia 30328, for purposes relating to the annual meeting, during normal business hours for a period of ten days before the meeting.

As of December 11, 2019,8, 2021, there were 31,383,04831,459,708 shares of Beazer common stock issued and outstanding. Holders of Beazer common stock are entitled to one vote per share and are not allowed to cumulate votes in the election of directors.

HOW TO VOTE

If your shares of Beazer common stock are held by a broker, bank or other nominee (in “street name”), you will receive instructions from them on how to vote your shares. As further described below, if your shares are held in street name and you do not give your broker, bank or other nominee specific instructions on how to vote your shares, the entity holding your shares may vote them at its discretion on any “routine” matters; however, your shares will not be voted on any “non-routine” matters. An absence of voting instructions on any “non-routine” matters will result in a “broker non-vote.”

The only “routine” matter to be acted upon at the annual meeting is Proposal No. 2: ratification of appointment of Deloitee & Touche LLP as the Company’s independent auditors. All other matters to be acted upon at the annual meeting are “non-routine” matters. Accordingly, if you hold all or any portion of your shares in street name and you do not give your broker, bank or other nominee specific instructions on how to vote your shares, your shares will not be voted on any of the following “non-routine” matters:

| | | | | |

l | Proposal 1: election of directors; |

l | Proposal 3: advisory vote to approve the compensation of the Company’s named executive officers; |

| Proposal 4: amendment of the Company's Amended and Restated Certificate of Incorporation; and |

l | Proposal 4:5: approval of the Company's amended and restated 2014 Long-Term Incentive Plan.a new Section 382 Rights Agreement. |

If you hold shares of Beazer common stock in your own name (as a “stockholder of record”), you may vote your shares:

| | | | | |

| over the Internet by following the instructions provided in the Notice of Internet Availability of Proxy Materials; |

| if you requested to receive printed proxy materials, by using the toll-free telephone number listed on the enclosed proxy card (specific directions for using the telephone voting system are included on the proxy card); or |

| if you requested to receive printed proxy materials, by marking, signing, dating and returning the enclosed proxy card in the postage-paid envelope provided. |

Whichever method you use, your shares of Beazer common stock will be voted as you direct. If you designate the proxies named in these proxy materials to vote on your behalf, but do not specify how to vote your shares, they will be voted:

| | | | | |

l | FOR the election of the director nominees; |

l | FOR the ratification of appointment of Deloitte & Touche LLP as the Company’s independent auditors; |

l | FOR approval of the compensation of the Company’s named executive officers; |

l | FOR approvalamendment of the Company's amendedAmended and restated 2014 Long-Term Incentive Plan; andRestated Certificate of Incorporation; |

l | FORapproval of a new Section 382 Rights Agreement; and |

| In accordance with the judgment of the persons voting the proxydesignated or named as proxies on any other matter properly brought before the meeting or any adjournments or postponements of the annual meeting. |

REVOKING A PROXY

You may revoke your proxy by submitting a new proxy with a later date by Internet, telephone or mail (if applicable), by voting at the meeting, or by filing a written revocation with Beazer’s corporate secretary. Your attendance at the annual meeting alone will not automatically revoke your proxy. If you vote in advance using one of the above methods, you may still attend and vote at the meeting.

QUORUM

QUORUM

A majority of the shares of Beazer common stock outstanding and entitled to vote on the record date will constitute a quorum, permitting the business of the annual meeting to be conducted. If your shares are present in person or by proxy, your shares will be part of the quorum.

VOTES NEEDED

Election of Directors

You may vote FOR or AGAINST any or all director nominees or you may ABSTAIN as to one or more director nominees. In order to be elected, the number of votes FOR a director must exceed the number of votes AGAINST such director. As set forth in our bylaws, only votes FOR or AGAINST the election of a director nominee will be counted. AbstentionsABSTENTIONS and broker non-votes count for quorum purposes, but not for purposes of the election of directors. A vote to ABSTAIN is not treated as a vote FOR or AGAINST and will have no effect on the outcome of the vote.

Ratification of Appointment of Independent Auditors

You may vote FOR or AGAINST the ratification of the appointment of Deloitte & Touche LLP as the Company’s independent auditors or you may ABSTAIN. A majority of the shares of common stock present in person or represented by proxy at the annual meeting and entitled to vote must be voted FOR approval of this matter in order for it to pass. Votes cast FOR or AGAINST and ABSTENTIONS with respect to this matter will be counted as shares entitled to vote on the matter. Broker non-votes are not applicable to this matter. A vote to ABSTAIN will have the effect of a vote AGAINST the matter.

Approval of the Compensation of Our Named Executive Officers

You may vote FOR or AGAINST the approval of the compensation of our named executive officers or you may ABSTAIN. A majority of the shares of common stock present in person or represented by proxy at the annual meeting and entitled to vote must be voted FOR approval of this matter in order for it to pass. Votes cast FOR or AGAINST and ABSTENTIONS with respect to this matter will be counted as shares entitled to vote on the matter. Broker non-votes will not be counted as shares entitled to vote on this matter. A vote to ABSTAIN will have the effect of a vote AGAINST the matter. As an advisory vote, this proposal is not binding. However, our Board and Compensation Committee will consider the outcome of this vote when making future compensation decisions for our executive officers.

Approval of theAmendment to Company’s Amended and Restated 2014 Long-Term Incentive PlanCertificate of Incorporation

You may vote FOR or AGAINST the proposed amendment to the Company’s Amended and Restated Certificate of Incorporation or you may ABSTAIN. A majority of all outstanding shares of common stock entitled to vote must be voted FOR approval of this matter in order for it to pass. Votes cast FOR or AGAINST and ABSTENTIONS with respect to this matter and broker non-votes will be counted as shares entitled to vote on the Company's amendedmatter. ABSTENTIONS and restated 2014 Long-Term Incentive Planbroker non-votes will have the effect of a vote AGAINST the matter.

Approval of New Section 382 Rights Agreement

You may vote FOR or AGAINST the new Section 382 Rights Agreement or you may ABSTAIN. A majority of the shares of common stock present in person or represented by proxy at the annual meeting and entitled to vote must be voted FOR approval of this matter in order for it to pass. Votes cast FOR or AGAINST and ABSTENTIONS with respect to this matter will be counted as shares entitled to vote on the matter. Broker non-votes will not be counted as shares entitled to vote on this matter. A vote to ABSTAIN will have the effect of a vote AGAINST the matter.

Other Business

The affirmative vote of a majority of the shares cast at the annual meeting is required for approval of any other business that may properly come before the meeting or any adjournmentadjournments or postponements thereof. Only votes FOR or AGAINST approval of any other business will be counted. Abstentions and broker non-votes count for quorum purposes, but not for the voting on the approval of such other business.

WHO COUNTS THE VOTES

Representatives of Broadridge Financial Solutions, Inc. will tabulate the votes and act as inspectors of the election.

EXPENSES OF SOLICITATION

Expenses incurred in connection with the solicitation of proxies will be paid by the Company. In addition, we have engaged MacKenzie Partners, Inc. to assist in the solicitation of proxies. We anticipate that the costs associated with this engagement will be approximately $19,500 plusplus costs and expenses incurred by MacKenzie. We will reimburse banks, brokerage firms and other custodians, nominees and fiduciaries for costs incurred in connection with this solicitation.

CORPORATEESG

ENVIRONMENTAL, SOCIAL AND GOVERNANCE

We view our ESG program as a key focus of our strategic planning and risk oversight responsibilities and a process of continuous improvement. Accordingly, we continually look for ways to measure, monitor and reduce our carbon footprint and waste, equally and equitably employ and retain diverse talent across our organization, facilitate access to energy-efficient, lower cost of ownership homes, and contribute to the communities in which we live and operate, all while upholding our code of ethics and corporate governance principles.

The following few pages highlight several aspects of our ESG program. We recently posted on our website our ESG Summary, which contains more detailed information on our ESG-related initiatives, as well as metrics that are responsive to sustainability accounting standards promulgated by the Sustainability Accounting Standards Board (SASB) for companies within the homebuilding industry. Our ESG Summary represents another step forward in our commitment to meaningful ESG accountability and provides a foundation upon which we expect to build increased transparency by directly reporting on relevant sustainability issues, risks and opportunities that impact our business.

DIRECTOR INDEPENDENCEESG

ENVIRONMENTAL HIGHLIGHTS

As a homebuilder, we recognize the critical role we play not only in creating durable and growing value for our customers, but also acting as a responsible steward in creating a sustainable future. We work with industry-leading partners who value innovation and quality and embrace environmentally friendly processes and objectives. We also use advanced construction practices and materials designed to provide our customers with lower carbon producing, energy-efficient homes that have demonstrated high-performance and lower costs of ownership.

Examples of our commitment to the environment include our approach to land acquisition, planning and development, our Net Zero Energy Ready commitment described below and our use of third-party programs such as ENERGY STAR® and Indoor airPLUS.

| | | | | |

| In 2021, we received the 2021 ENERGY STAR Partner of the Year—Sustained Excellence Award from the EPA for the sixth consecutive year. Beazer was one of only three publicly-traded homebuilders to receive this award in 2021 for all its markets. |

| |

| In addition to our partnership with the EPA’s ENERGY STAR program, we incorporate a variety of energy-efficient and high-quality products into our homes that also reduce waste output, including those relating to insulation, air and water sealing and technologies. Since 2010, we have installed EPA-certified WaterSense fixtures in 100% of our homes to provide homeowners with increased water efficiency. More recently, we began building our homes in accordance with the EPA’s Indoor airPLUS specifications, which provides our homeowners with better comfort, durability and indoor air quality. |

| |

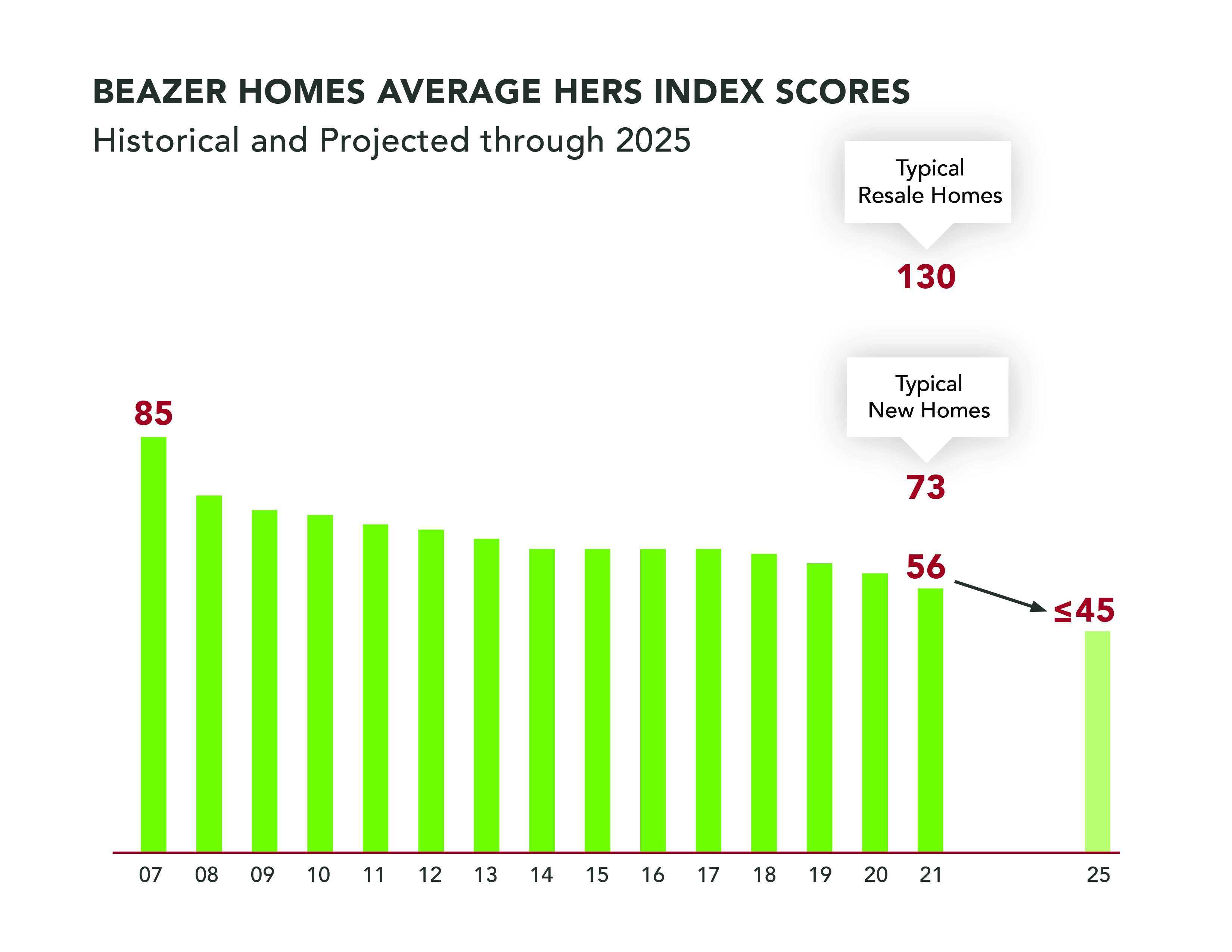

The Home Energy Rating System (HERS®) is the industry-leading home building scoring system developed by the Residential Energy Services Network (RESNET) for inspecting and calculating a home’s energy performance after construction is complete. The HERS methodology measures the energy efficiency of a home on an easy-to-understand scale: the lower the HERS Index Score, the more energy efficient the home and the more it reduces greenhouse gas (GHG) emissions over its lifetime.

Only a small portion of newly built homes in the U.S. are subjected to the HERS measurement. In 2021, the estimated average HERS Index Score among typical newly built homes was 73, while the average HERS Index Score for Beazer built homes in 2021 was 56. Beazer Homes always reports its average HERS Index Scores as "gross" scores. A gross HERS Index Score is a more rigorous standard because it excludes the benefit of renewable energy technologies. By the end of 2025, every new Beazer home will be independently verified as having a gross HERS Index Score of 45 or less.

OUR NET ZERO ENERGY READY COMMITMENT | | | | | |

| In December 2020, we became the first U.S. national homebuilder to publicly commit to ensuring that by the end of 2025 every home we build will meet the requirements of the U.S. Department of Energy’s (DOE) Zero Energy Ready Home Program. The DOE’s Zero Energy Ready Home program builds upon current HERS standards and the comprehensive requirements of the EPA’s ENERGY STAR program and incorporates other building science innovations and practices to achieve at least 40%-50% greater energy efficiency than a typical new home. DOE Zero Energy Ready homes are verified and certified by a qualified third-party inspector. |

| Building 100% of our homes as Net Zero Energy Ready will significantly reduce the amount of GHG emissions produced over the lifespan of our homes. Our Net Zero Energy Ready homeowners will be able to achieve net zero energy by attaching a properly sized renewable energy system, such as a solar photovoltaic system, that will generate as much energy as the home consumes. Our Net Zero Energy Ready commitment represents an entirely new level of quality, comfort and innovation for our customers. |

ESG

SOCIAL HIGHLIGHTS

Health and Safety

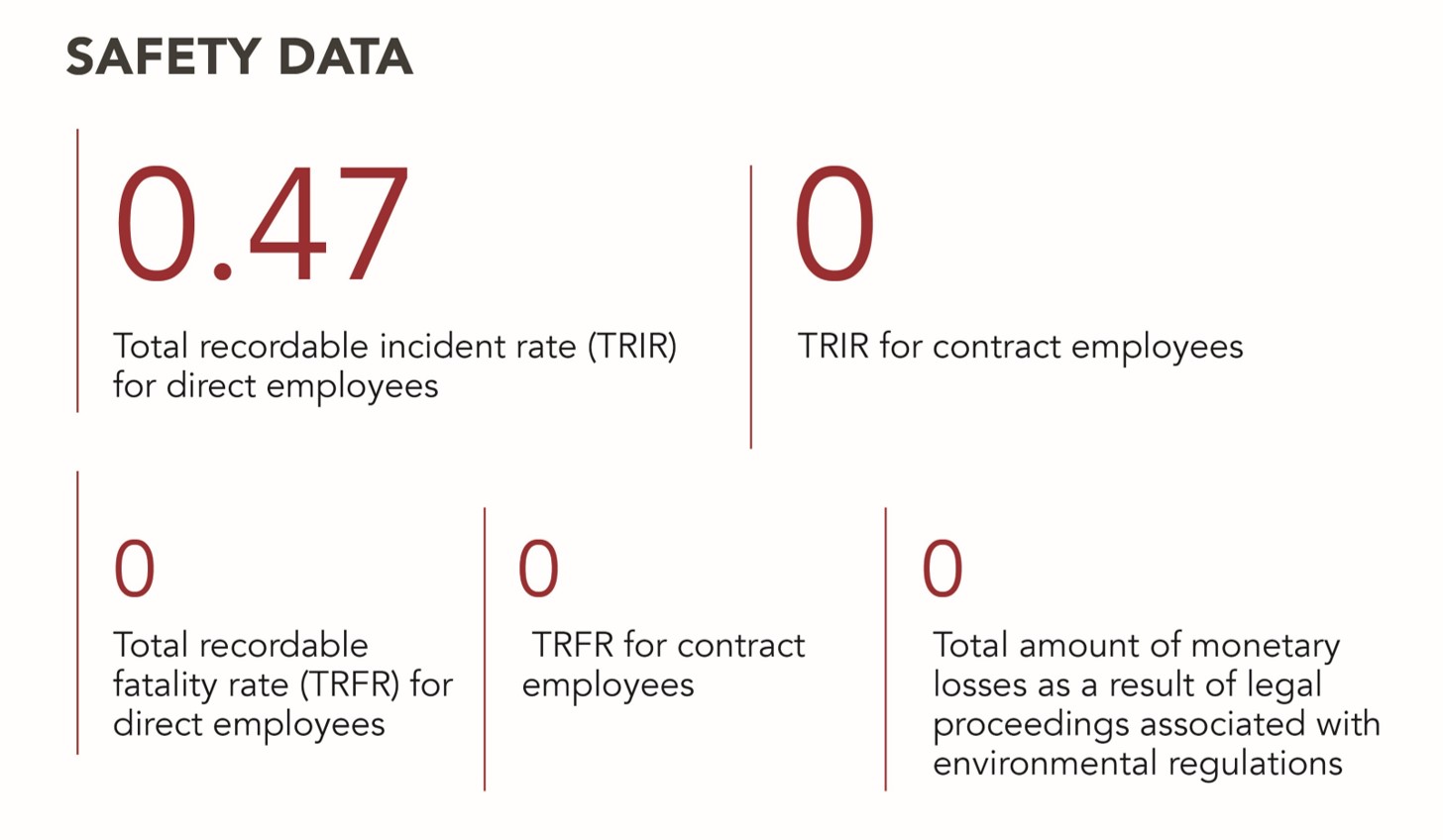

Our highest priority is the health, safety and well-being of our employees, which we believe is critical to our continued growth and success. We are guided by four principles that are non-negotiable: safety, integrity, respect and inclusion, and we strive to live up to these principles in all aspects of our operations, including life-work balance, career and personal development opportunities, our flexible time-off program and industry-leading parental leave policies.

We require extensive and ongoing training of our team members, including safety training pursuant to our safe practices manual. All field employees and new home counselors are required to complete the certified Occupational Safety and Health Administration (OSHA) 10-hour construction training course.

Our commitment to actively engaging with our team members is a key component of our culture. Over 95% of our employees completed our 2021 annual employee engagement survey, and 95% of those employees indicated they would recommend working at Beazer Homes.

Inclusion and Diversity

We are committed to building an inclusive culture in which everyone feels welcome, respected, safe and valued. By embracing diversity in all its forms, we will better serve our employees, customers, partners and communities. Our Board of Directors and senior leaders oversee our efforts to prioritize and improve the diversity of our organization. As we continue to progress in this area, we are reaching across all facets of our functional and operational areas, including recruitment, employee engagement, retention, employee development and training and promotions.

Beazer Homes is also committed to pay equity. We utilize a third-party to complete an annual pay parity audit to determine if there are pay disparities across gender or race. If audit results identify any outliers, we examine the circumstances and take corrective action as warranted.

While we are proud of the successes we have had, particularly in fostering gender diversity and pay equity within our organization, we continue to work to increase the diversity of our teams across all levels of our company.

Our goal is to provide to our customers homes with extraordinary value at an affordable price. We focus on building efficient homes with quality, high-performing materials while making the construction and purchase process an enjoyable experience. We are committed to our customers receiving consistent and clear communication throughout their purchase and build process, including what is happening next, why it is done that way and how that process helps to provide a quality-built home for them. We believe transparency is critical to creating a great customer experience.

| | | | | |

| Across our Company, Beazer team members are committed to supporting causes that make a difference. From local service activities to Company-wide initiatives, giving back is a central element of our culture, championed by passionate employees and embraced by partners who share our commitment to have a positive impact on the communities we serve. |

| In 2020, we announced our newest commitment to our customers and communities, the development of a new, wholly-owned title insurance agency, Charity Title. |

| Charity Title donates 100% of its profits to the Beazer Charity Foundation, our company’s philanthropic arm, which provides donations to national and local nonprofits. Charity Title net profits were approximately $900,000 in 2021. Going forward, with the full rollout of Charity Title operations across our footprint (which is scheduled to be completed in 2022), we expect charitable funding to well exceed $1,000,000 annually. |

ESG

CORPORATE GOVERNANCE OVERVIEW

Our Board of Directors has evaluated all business and charitable relationships between the Company and the Company’s directors during fiscal 20192021 as required by the Company’s Corporate Governance Guidelines. As a result of this evaluation, the Board has determined that each non-employee director (all directors(each director other than Mr. Merrill) is an “independent director” as defined by the standards for director independence established by applicable laws, rules and listing standards including the standards for independent directors established by The New York Stock Exchange Inc. (NYSE) and the Securities and Exchange Commission (SEC). The Company’s Corporate Governance Guidelines are available on the Company’s website at beazer.com.

The Corporate Governance Guidelines require that non-employee directors meet in executive session as part of each regularly scheduled meeting of the Board. These executive sessions are called and chaired by our Lead Director. Under our Corporate Governance Guidelines, the Lead Director is an independent director who is elected by the affirmative vote of a majority of the independent directors. In addition to chairing executive sessions of the independent directors, the Lead Director discusses with the other independent directors management'smanagement’s proposed meeting agendas for meetings of the Board and reviews approved meeting agendas with our chief executive officer,Chief Executive Officer, leads the discussion with our chief executive officerChief Executive Officer following the independent directors' executive sessions and leads periodic discussions with other Board membersdirectors and management concerning the Board's information needs.

BOARD LEADERSHIP STRUCTURE AND GOVERNANCE PRACTICES

Board Leadership Structure

Our Board regularly reviews all aspects of its governance profile, including its leadership structure. As part of this review, and in connection with the decision by our former Chairman, Mr. Zelnak, to retire from the Board, our Board has determined that a combined CEO-Chairman coupled with an empowered and independent Lead Director would beis the most appropriate corporate governance structure for the Company and its stockholders at this time. Accordingly, in November 2019, our Board appointed Mr. Merrill as Chairman and Ms. Provencio as Lead Director.

Mr. Merrill was appointed as Chairman based onand continues to serve as Chairman because of his leadership skills, experience in and knowledge of the homebuilding sector — including his leadership and experience as former Chair of the Policy Advisory Board of the Joint Center for Housing Studies at Harvard University and as former Chair of the Leading Builders of America, an industry trade association.association, and his service as a member of the Freddie Mac Board of Directors. In addition, the Board recognized Mr. Merrill'sMerrill’s exemplary tenure at the Company — includingwhich now includes more than 1214 years of service, over eightten of which as President and CEO. The Board believes that Mr. Merrill’s continued leadership is essentialbest positions the Company to meeting the Company’sachieve its long-term strategic objectives.

The independent directors of the Board appointed Ms. Provencio as Lead Director because she possesses the experience, qualities and skills necessary for the role, including high personal integrity and a readiness to challenge management when appropriate, drawing on more than 30 years of experience in the public accounting field and 1012 years of service to the Board. Our Board believes Ms. Provencio is highly qualified to discharge responsibilities that are consistent with the duties of an independent Lead Director, including presiding at all meetings of independent directors, consulting on all meeting schedules and agendas, being available for direct consultation with the Company’s stockholders, and assisting with the Board’s thorough CEO evaluations, Board evaluations and succession planning activities. For more information on the role and responsibilities of our Lead Director, see Exhibit A ("(“Lead Director Role and Responsibilities"Responsibilities”) to our Corporate Governance Guidelines, which are available on the Company'sCompany’s website at beazer.com.

Our Board believes that its new leadership structure, together with the Company’s already strong corporate governance practices, creates a productive relationship between the Board and management, including strong independent oversight. Our Board will continue to review its leadership structure regularly.

Majority Vote Standard and Director Resignation Policy

Our Bylaws and Corporate Governance Guidelines provide a majority voting standard for the election of directors in uncontested elections. Director nominees will be elected if the votes cast for such nominee exceed the number of votes cast against such nominee. In the event that (i) a stockholder proposes a nominee to compete with nominees selected by our Board, and the stockholder does not withdraw the nomination prior to our mailing the notice of the stockholders meeting, or (ii) one or more directors are nominated by a stockholder pursuant to a solicitation of written consents, then directors will be elected by a plurality vote.

The Corporate Governance Guidelines provide that our Board will only nominate candidates who tender their irrevocable resignations, which are effective upon (i) the candidate not receiving the required vote at the next annual meeting at which they face reelection and (ii) our Board of Directors accepting the candidate’s resignation. In the event that any director does not receive a majority vote, then pursuant to our Corporate Governance Guidelines, the Nominating/Corporate Governance Committee or NCG Committee,(NCG Committee) will act on an expedited basis to determine whether to accept the director’s resignation and will submit its recommendation to the Board. In deciding whether to accept a director’s resignation, the Board and the NCG Committee may consider any factors that they deem relevant. Our Corporate Governance Guidelines also provide that the director whose resignation is under consideration will abstain from the deliberation process. All candidates standing for reelection at the annual meeting have tendered such resignations.

Risk Oversight

Effective risk oversight is a priority for our Board. The goal of the Company’s risk management process is to understand and manage riskkey strategic and operational risks, identified as having a material impact on the Company, in accordance with the Board’s tolerance for risk. The entire Board oversees and engages with senior executives on key ESG matters, including organizational inclusion and diversity programs, equitable pay practices, environmental programs and initiatives and sustainability matters. All committees report on the risk categories they oversee to the full Board.

Our Board has delegated primary responsibility for overseeing our risk management process to the Audit Committee. The Audit Committee oversees our risk identification and mitigation processes and specifically oversees management of our financial, legal and fraud policies, as well as our regulatory compliance and cybersecurity risks. This includes regular evaluation of risks related to the Company’s financial statements, including internal controls over financial reporting. Members of management, including our Chief Financial Officer, General Counsel, Compliance Officer and Director of Internal Audit, report to the Audit Committee on a quarterly basis regarding on-going risk management activities. In addition, the Audit Committee and the full Board receive regular reports from our Chief TechnologyInformation Officer and other members of senior management regarding their assessment of cybersecurity and related risks to the Company, as well as ongoing cybersecurity initiatives. The Audit Committee also oversees the internal audit function and our independent auditors and meets separately on at least a quarterly basis with our Compliance Officer, Director of Internal Audit and representatives of our independent auditors as part of this oversight responsibility.

Our Compensation Committee periodically reviews our compensation philosophy and program designs to help ensure that our compensation programs, including those applicable to our executives, do not encourage inappropriate risk taking that could have a materially adverse impact on the Company. The Compensation Committee works with its independent compensation consultant, Pearl Meyer, to structure executive compensation plans that are appropriately aligned with key businessfinancial, operational and strategic objectives, company performance and stockholder interests. For more information on risk considerations in our compensation programs, please see “Compensation Discussion and Analysis — Elements of Fiscal 20192021 Compensation Program — Risk Considerations in Our Compensation Programs” below.

Our Finance Committee oversees risks relating to liquidity, capital structure and investments, including land acquisition and development. The Finance Committee, as well as the Board as a whole, reviews our long-term strategic plans, annual budget, capital commitments, cash needs and funding plans. Management is responsible for identifying and managing these risks, while directors provide oversight to management in this process.

Our Nominating/Corporate GovernanceNCG Committee oversees risks relating to governance matters. The NCG Committee also oversees our ethics program, including implementation of our Code of Business Conduct and Ethics, and compliance by directors and management with the corporate governance and ethics standards of the Company.

Environmental and Social Responsibility

We are committed to contributing to the sustainability of communities through our support for a variety of charitable foundations; promoting safety, diversity and inclusion in our workforce; and building our homes and communities with a concern for their impact on the environment. Our Board of Directors provides oversight of environmental and social matters, and is committed to supporting our efforts to operate as a good corporate citizen. Some highlights of our accomplishments in these areas appear below.

Environmental Responsibility

We are committed to making home ownership more affordable and building our homes with a concern for their impact on the environment. We work with industry-leading partners who, like us, provide innovation and quality and foster environmentally-friendly processes. Our construction practices are designed to provide our customers with healthy and comfortable indoor environments, while contributing to sustainability of the communities in which we operate.

Beazer Homes has participated in the ENERGY STAR® Program since 1998, certifying over 63,000 new homes during that period. In 2019, we were selected as an ENERGY STAR Sustained Excellence Partner of the Year for the fourth consecutive year, and we continue to focus on energy efficiency by partnering with ENERGY STAR to assure 100% of our homes meet or exceed ENERGY STAR program requirements. With a focus on durability and energy efficiency, we have effectively contributed to the reduction of greenhouse emissions by saving the environment over 12,000 metric tons of CO2 equivalent emissions in 2019 alone and, since 2011, over 100,000 metric tons of CO2 equivalent emissions.

We also foster new sustainability initiatives as we work to protect the quality of our environment. Our efforts include implementing programs such as energy-efficient homes with ACH (Air Changes per Hour) ratings better than industry standards, which lessens the impact on our environment of maintaining a comfortable home. This is accomplished through whole home weatherization and efficiency systems, internal quality inspections and a rigorous 3rd party quality inspection program that tests every home we build, all of which are designed to assure consistency with our high expectations on construction standards.

Another example of our efforts in this area is our National Storm Water Program, which has been developed to ensure we are protecting the environment and complying with applicable federal, state and local regulations. This helps us design and build our neighborhoods to better manage the flow of rain water through the community, while helping to keep materials such as dirt, paint, concrete residue, oils or other waste from leaving our construction sites.

We continue to incorporate efficient and waste-reducing practices into home building, offering long-term benefits to both consumers and the environment. For example, we are engaged in a project with EntekraTM Fully Integrated Off-Site Solutions for framing systems in Sacramento, California. Our homes framed as part of this project are constructed more efficiently, with a cleaner job-site and reduced waste. More broadly, during fiscal 2019, we focused on a continuing objective to simplify our product offerings, which includes streamlining our plan and structural options, as well as design selections, to improve efficiency, reduce costs and minimize waste at construction sites.

Social Responsibility

Safety is a core principle at Beazer, and a healthy and safe working environment for our employees is our highest priority. We are also committed to fostering a diverse and inclusive environment, with equal employment opportunity hiring practices and policies. Our benefits package is highly-competitive, with industry-leading PTO and parental leave policies.

We strive to put our customers first in everything we do, and we differentiate ourselves from our competition by: (1) offering flexible floor plans that provide personalization of living space at no additional cost; (2) building into every Beazer home exceptional quality and comfort that translates into a lower cost of ownership; and (3) saving our customers thousands of dollars on their home loan with our Mortgage Choice program that makes it easy to compare multiple loan offers from competing lenders.

We take seriously our responsibility to strengthen the communities in which we operate. In addition to various division-level initiatives that serve local communities, we have a long-standing partnership with the Fisher House Foundation, a

not-for-profit organization that builds comfort homes where military and veterans’ families can stay free of charge while a loved one is in the hospital. We have significant participation from our employees in charitable activities, such as the 2019 Rock ‘n Roll Marathon, where our employees raised and contributed over $200,000 to support the Fisher House Foundation, the MS 150, a two-day bike ride to support the National Multiple Sclerosis Society, and numerous local-community charitable projects, including Operation FINALLY HOME, which provides mortgage-free homes to military families.

STANDING COMMITTEES AND

MEETINGS OF THE BOARD OF DIRECTORS

The four standing committees of the Board are the: Audit Committee, Nominating/Corporate GovernanceNCG Committee, Compensation Committee and Finance Committee. Below are our current directors and their committee memberships. Each of our directors attended at least 75% of the regularly scheduled Board and committee meetings during the period they were on the board, with seven of eight attending 100% of such meetings. Actions taken by these committees are reported to the Board of Directors at the next following Board meeting. All directors then serving on the Board attended the Company’s 20192021 annual meeting of stockholders held on February 6, 2019.3, 2021. The table below shows the current membershipnumber of the Board and each standing committee, and the number offormal meetings held during fiscal 2019. Directors who are retiring from the Board at the annual meeting are noted below, as are the two directors who joined the Board during the fourth quarter of fiscal 2019:2021.

| | | | | | | | | | | | | | | | | | | | |

| BOARD | AUDIT | COMPENSATION | NOMINATING/CORPORATE GOVERNANCE | FINANCE | ATTENDANCERATE |

| Elizabeth S. Acton | l | l | | | l | 100% | |

| Laurent Alpert | l | | | l | l | 100% | |

| Brian C. Beazer* | l | | l | | l | 100% | |

| Peter G. Leemputte* | l | l | | l | | 100% | |

| Allan P. Merrill | l | | | | | 100% | |

| Peter M. Orser | l | | l | | l | 100% | |

| Norma A. Provencio | l | | l | l | | 100% | |

| Danny R. Shepherd | l | l | l | | | 100% | |

| David J. Spitz** | l | | l | | | 100% | |

| C. Christian Winkle** | l | | | | l | 100% | |

| Stephen P. Zelnak, Jr.* | l | l | | l | | 94% | |

| Number of Meetings in 2019 | 5 | 6 | 4 | 7 | 6 | |

| | | | | | | | | | | | | | | | | |

| BOARD | AUDIT | COMPENSATION | NOMINATING/CORPORATE GOVERNANCE | FINANCE |

| Elizabeth S. Acton | l | l | | | l |

| Lloyd E. Johnson | l | l | l | | |

| Allan P. Merrill | l | | | | |

| Peter M. Orser | l | | l | | l |

| Norma A. Provencio* | l | | l | l | |

| Danny R. Shepherd | l | l | | l | |

| David J. Spitz | l | | l | l | |

| C. Christian Winkle | l | l | | | l |

| Number of Meetings in 2021 | 7 | 6 | 6 | 8 | 5 |

lChair

*Retiring director. Lead Director

**Director appointed during the fourth quarter of fiscal 2019.

AUDIT COMMITTEE

Our Audit Committee assists the Board in its oversight responsibility relating to:

| | | | | |

l | The integrity of the Company’s consolidated financial statements, accounting and financial reporting processes, and systems of internal controls over accounting and financial reporting; |

l | The Company’s compliance with legal and regulatory requirements; |

| | | | | |

l | The independent auditor’s qualifications, independence and performance, including sole authority for appointment, compensation, oversight, evaluation and termination; |

l | The performance of the Company’s internal audit function; |

l | The Company's management of cybersecurity, data privacy and related risks; |

| The report of the Audit Committee required by the rules of the SEC, as included in this proxy statementstatement; |

l | Reviewing related party transactions,transactions; and |

l | The fulfillment of the other responsibilities set out in its chartercharter. |

Our Board has determined that all members of the Audit Committee are “financially literate” under NYSE rules and also qualify as financial experts, as defined in Item 407 of Regulation S-K under the Securities Act of 1933, as amended. Our Board also has reviewed the composition of the Audit Committee pursuant to the rules of the SEC and NYSE governing audit committees and confirmed that all members of the Audit Committee are independent under such rules.

NOMINATING/CORPORATE GOVERNANCE COMMITTEE

As described further below, the duties of our NCG Committee include recommending to the Board the slate of director nominees submitted to stockholders for election at each annual meeting and proposing qualified candidates to fill vacancies on the Board. The NCG Committee is also responsible for developing corporate governance principles for the Company and overseeing the evaluation of the Board of Directors. Our Board has reviewed the composition of the NCG Committee pursuant to the rules of the NYSE governing nominating and governance committees and confirmed that all members of the NCG Committee are “independent” under such rules.

The NCG Committee considers director nominee recommendations from executive officers of the Company, independent members of the Board and stockholders of the Company, as well as recommendations from other interested parties. The NCG Committee may also retain an outside search firm to assist it in finding appropriate nominee candidates. Stockholder recommendations for director nominees received by the Company’s corporate secretary (at the address for submitting stockholder proposals and nominations set forth under the heading “Procedures Regarding Director Candidates Recommended by Stockholders” below) are forwarded to the NCG Committee for consideration.

During 2019,

Our Compensation Committee reviews the Company’s management resources and structure and administers the Company’s cash- and equity-based compensation programs for directors and management, which includes our NEOs. Our Board has reviewed the composition of the Compensation Committee pursuant to the rules of the NYSE governing compensation committees and confirmed that all members of the Compensation Committee are “independent” under such rules.

Our Finance Committee provides assistance to the Board by reviewing from time to time matters concerning corporate finance, including equity and debt financings, acquisitions and divestitures, share and debt repurchases and dividend policy.

COMMITTEE CHARTERS AND OTHER INFORMATION

Interested parties may access electronic copies of the charters of our Audit Committee, NCG Committee, Compensation Committee and Finance Committee at beazer.com. Our Corporate Governance Guidelines and our Code of Business Conduct and Ethics, which meet the requirements of a code of ethics under applicable SEC regulations and NYSE standards, are also available on the Company’s website. Printed copies of any of these documents may be requested by writing to the Company’s corporate secretary at 1000 Abernathy Road, Suite 260, Atlanta, Georgia 30328.

DIRECTOR, BOARD AND COMMITTEE EVALUATIONS

Our Board recognizes that a robust and thorough evaluation process is an important element of corporate governance and enhances our Board’s effectiveness. Therefore, each year, the NCG Committee oversees the evaluation process, which includes personal interviews with each director during which the performance of individual directors, the full Board and the committees of the Board are assessed. Areas of improvement are also solicited during these interviews. These assessments are then reviewed and shared with the full Board during executive session.

Pursuant to our Corporate Governance Guidelines, the NCG Committee is directed to work with our Board on an annual basis to determine the appropriate qualifications, skills and experience for each director and for our Board as a whole. In evaluating these characteristics, the NCG Committee and our Board take into account many factors, including the individual director’s general understanding of our business on an operational level, as well as his or her professional background and willingness to devote sufficient time to Board duties.

Our Board considers diversity of race, ethnicity, gender, age and professional accomplishments in evaluating director candidates. Each individual is evaluated in the context of our Board as a whole, with the objective of recommending a group of nominees that can best promote the success of our business and represent stockholder interests through the exercise of sound judgment based on diversity of experience and background.